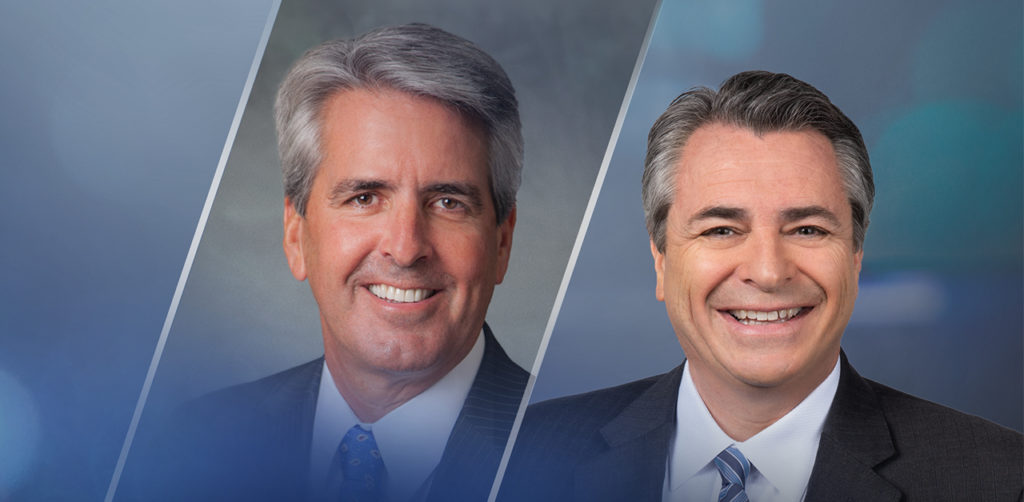

The Coming Rebound with David Stevens

Buffini Coaching LIVE – OPTIMIZE is a virtual event designed to help you master AI-driven marketing, sales, and business strategies that will position you as a leader in the rapidly changing world of real estate. Join Brian Buffini and special guest Michael Thorne for this powerful event packed with practical action steps that will help you crush the second half of 2025! Learn more here.

In the present climate, there’s a lot of misinformation and uncertainty in the marketplace. I recently had the pleasure of interviewing David Stevens, Chief Executive Officer at Mountain Lake Consulting, Inc., and former CEO and President of the Mortgage Bankers Association (MBA), about the current economic situation. Here are some of the top takeaways:

This Crisis Is Different to the Last Recession

The COVID-19 crisis is unlike anything we have ever experienced before. The last global recession was caused by a credit collapse, but this is a very different scenario. Before this sudden storm hit so quickly, the economy was very strong, we were on track to have a booming housing market and the biggest concern in the industry was a lack of inventory. Right now, we’re in the eye of the storm, but this too will pass. It’s predicted there will be an 18 percent decline in GDP this quarter, but an 11 percent increase in the next. Once people can get back to work, the downward trend will stop in its tracks and there will be an immediate pop back. It won’t be back to where it was, but it will happen quickly.

Real Estate Will Recover Quickly

Real estate is likely to be one of the first industries out of the crisis. When we come out of this, there will still not be enough housing inventory to meet demand, which means that any house price downturns will be very minor. Also, during the last recession, household formation was declining but, this time around, the country’s demographics mean it is growing. Because of limited supply, pent-up demand and record low interest rates, when conditions ease it is expected that there will be significant movement in the real estate marketplace.

Millennials Will Be Central to a Rebound

Unlike a decade ago, when they might have still been in college or living with their parents, many Millennials are now ready to look for homes of their own. Today, the percentage of 30-year-olds with mortgages is about 10 percent lower than in previous decades. This is because many people in this age bracket have been renting and delaying their buying decision. This may now change. During the pandemic, people have had the opportunity to re-evaluate and many will decide that they want to change their circumstances and buy a property. Once these people return to work, the real estate market will experience a kickstart as a result.

Listen to the latest episode of “It’s a Good Life” to learn more.